Posts

You will have to opinion the financial agreement to see if your own bank’s mobile software enables you to deposit cashier’s checks otherwise money requests. A cellular deposit is actually a way to deposit report inspections you to you get. Yet not, you could send money to friends because of cellular banking without using a by using electronic percentage functions such Zelle®.

To find out more, excite refer to the new Digital Banking Arrangement for Online businesses and Mobile Banking. Monitors deposited having fun with Cellular Look at Put was available in accordance to your Finance Access Policy expose in our Business Deposit Membership Contract. All of our standard rules should be to allow you to withdraw currency placed on your account zero later on versus second business day just after a single day i show the new bill of your own deposit.

Our very own Chase College Checking℠ membership have great features for students and you can the fresh Pursue examining people can also enjoy that it special render. Financial of almost everywhere by cellular telephone, pill vogueplay.com our website otherwise computer and more than 15,one hundred thousand ATMs and you may 5,000 branches. When you are reordering inspections, seting up a primary put or an automatic fee otherwise preparing a cable tv transfer, you’ll probably be expected to include an ABA routing amount. This type of places qualify for Financial from The usa Advantage Along with Financial® and you will Older Discount Examining month-to-month fix payment waiver.

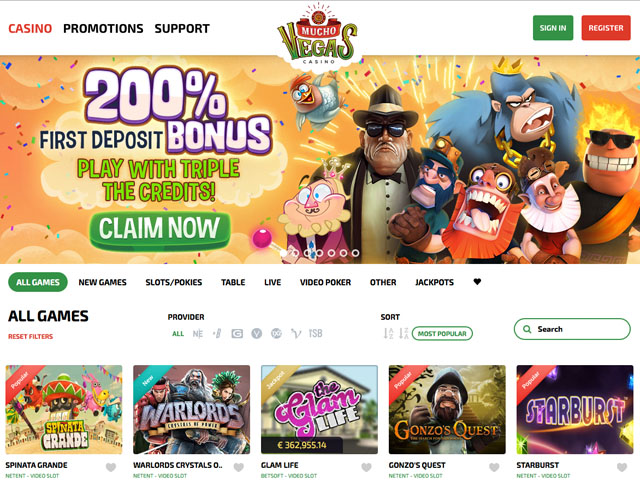

Below, we’ve gathered a list of tips for using the cellular consider deposit feature to suit your Desert Financial membership as well as important information to learn about this particular feature. Mobile put is actually provided to your bank’s on the internet financial system, offering availability from mobile app. Mobile put gambling enterprise websites costs charges for dumps and withdrawals having fun with particular tips; there are all of the direct costs in the casino’s terminology and requirements.

Wells Fargo Online and Wells Fargo Business online customers which manage a qualified examining otherwise savings account meet the requirements to use cellular deposits. A call at-person deposit to your bank teller allows you to quickly accessibility the newly placed finance. Even though Chime includes of a lot electronic banking have, it’s perhaps not a financial. The brand new app allows pages put monitors, find ATMs and take care of most other average financial work.

We think people should be able to generate monetary decisions which have trust. The newest app have a tendency to help you position the view within the frame and ensure correct bulbs. Play with a dark records to aid the fresh consider information stick out obviously from the images. Instead, you can just breeze an image, follow several encourages, and possess your consider cashed from the comfort of your own mobile phone. There aren’t any costs for using the new Cellular Consider Put feature. People factual statements about delay accessibility will be provided regarding the Safe Message Cardio, that is accessible in part of the navigation eating plan.

Just how Cellular View Put Functions

In other cases, the newest option concerns looking to greatest rates, all the way down or no costs, otherwise digital accessibility. Find the Pursue Overall Examining® give for brand new checking consumers. Look at Faq’s, how-to video or other info to help you get become having your membership. Consult your provider to have details of particular charge and you will costs. Come across answers to questions about precisely how cellular consider deposit performs, as well as utilizing it, what kinds of inspections you could deposit, and you will what to do that have a once you deposit it.

You deposit is possibly added to their month-to-month mobile phone bill or subtracted from your prepaid service equilibrium. Additionally you don’t need to bother about someone billing internet casino purchases so you can their mobile phone statement, as you need to confirm the brand new commission (always thru Text messages). Yes, you could deposit your own take a look at utilizing the cellular software if you’ve got a joint membership. You might have to have one another customers endorse the fresh view just before depositing it. Just after deposit a check with the cellular application, it’s important to safely store the newest actual search for a number of weeks in the eventuality of one difficulties with the fresh put. Extremely banking institutions do not accept article-old inspections for mobile put.

- This can takes place should your smartphone features a failing Websites or study connection.

- If the vacation falls to your a monday, including, your bank account would be available on Wednesday.

- Mobile deposit allows you to complete pictures of your back and front of your recommended look at.

- Additional third-party costs can get use, and Text messages and you may membership more than-restrict and money-aside charges.

- Having Eno, pages get informed of every unusual deals and you will prospective ripoff.

- Here are banking institutions and you will credit unions to your finest cellular financial feel.

Lender staff responsible for RDC characteristics is to receive appropriate knowledge in order to be sure conformity having bank rules and procedures in addition to current laws. Screening your own vendor is crucial to ensure they’ve been legitimate and you will competent. Extremely banks work on a vendor giving, installs, maintains, and you may condition the fresh equipment and you may software for RDC characteristics. From the 2008, two-thirds of all of the You.S. banking institutions had been giving RDC functions, centered on Celent, a worldwide financial features contacting business. See and implement to the Pursue for Organization credit card greatest fitted to your organization. Dumps generated for the a national escape often strike your bank account to the the initial time pursuing the 2nd business day.

Spend By the Cellular Gambling enterprises Faq’s

There are lots of banking institutions and you can borrowing unions that offer cellular consider put because the a choice. If your financial institution doesn’t offer they, you could consider beginning an account someplace else. Other than cellular deposit consider have, here’s what to consider when modifying financial institutions.

Register to start an on-line currency transfer now

Financial, dumps is actually simply for $fifty to the particular profile you to definitely refuge’t become discover for at least ninety days. Certain banking institutions demand for each and every-deposit fees if the a business is higher than a specific amount of month-to-month purchases. Commission info is actually in depth in the bank’s agenda and you may will vary commonly. Mobile look at put also offers a convenient and you may effective way to handle financial purchases without having any limitations away from real financial towns. Following these steps and you can adhering to demanded methods, you can confidently use this feature, simplifying the banking feel and you can saving time.

Spend careful attention to be sure there aren’t any typos, because this is also reduce running. Get more suggestions about ideas on how to manage their smart phone from ripoff. Definitely only deposit a good cheque once, either in person or digitally. If you mistakenly deposit a good cheque over and over again, speak to your financial institution immediately.